Selling a mortgage note involves transferring the rights to receive payments from the borrower to a new owner in exchange for a lump sum of cash. This process allows the original note holder to receive a large sum of money upfront, rather than waiting for monthly payments over an extended period of time. There are several benefits to selling a mortgage note for a lump sum. Firstly, it provides immediate access to a significant amount of cash, which can be used for investment opportunities, debt consolidation, or other financial needs.

Additionally, selling a mortgage note eliminates the risk of default or non-payment by the borrower, as the responsibility for collecting payments and bearing the associated risks shifts to the new note owner. Furthermore, the sale of a mortgage note can free up the original note holder’s resources and provide the flexibility to pursue other financial goals. Overall, selling a mortgage note for a lump sum can be a favorable option for individuals seeking to unlock the value of their mortgage loan and secure immediate financial stability.

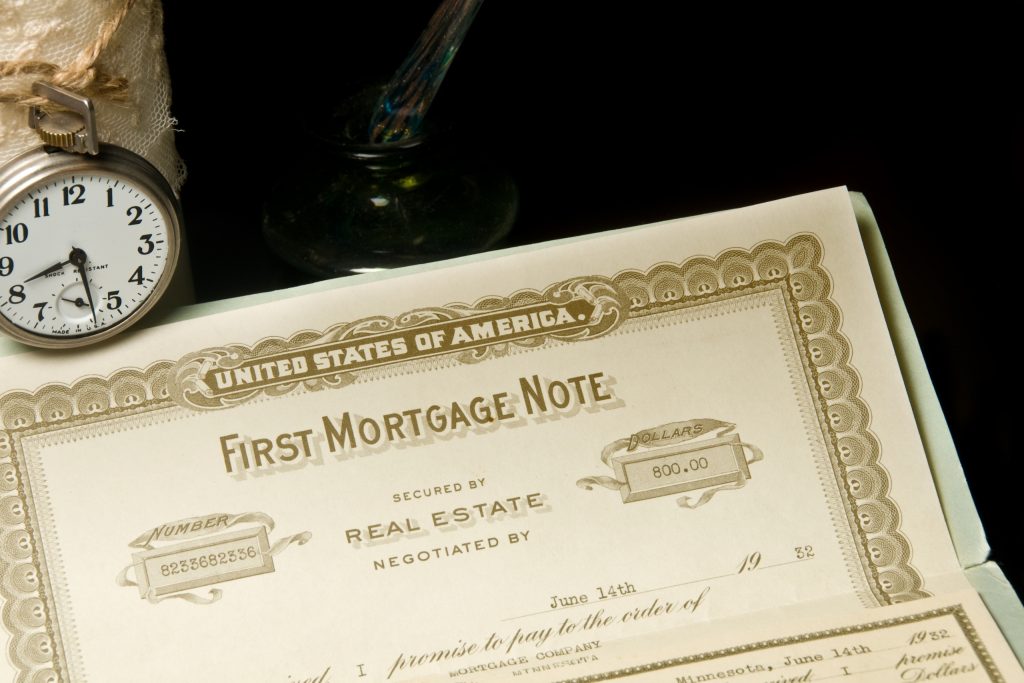

What is a Mortgage Note?

A mortgage note is a legal document that outlines the terms and conditions of a mortgage loan. It is a written promise to repay a specified amount of money, usually with interest, within a certain time frame. The mortgage note includes important details such as the loan amount, the interest rate, the payment schedule, and the consequences of defaulting on the loan. It is signed by the borrower and serves as evidence of the debt and the lender’s right to foreclose on the property if the borrower fails to make the agreed-upon payments.

The key difference between a mortgage note and a promissory note is that a mortgage note is specifically tied to a real estate property. It is a legal contract that outlines the terms of a mortgage loan, while a promissory note is a more general promise to repay a loan. The mortgage note creates a lien on the property, giving the lender the right to take possession of the property in the event of default, whereas a promissory note does not have this specific tie to a property. In summary, a mortgage note is a crucial part of the mortgage process, serving as a binding agreement between the borrower and the lender, outlining the terms and conditions of the loan.

Types of Mortgage Notes

There are various types of mortgage notes, each with its own unique characteristics. Two common types are fixed-rate and adjustable-rate mortgage notes.

A fixed-rate mortgage note has a set interest rate that remains constant throughout the life of the loan. This offers stability and predictability for homeowners, as their monthly payments remain the same. On the other hand, an adjustable-rate mortgage note has an interest rate that can fluctuate based on market conditions. This type of note may offer lower initial interest rates, but the payments can increase over time, making it important for homeowners to understand the potential for higher payments in the future.

It is crucial for homeowners to fully understand the type of mortgage note they have before considering selling their home. The type of mortgage note can impact the resale value of the home and also affect potential buyers’ financing options. Additionally, understanding the terms of the mortgage note can help homeowners make informed decisions about refinancing, prepayment penalties, and other financial considerations.

Ultimately, having a clear understanding of the type of mortgage note is essential for homeowners looking to sell their property, as it can significantly impact the selling process and potential financial outcomes.

The Value of Your Mortgage Note

The value of your mortgage note is determined by a variety of factors, including the interest rate of the loan, the term of the loan, and the creditworthiness of the borrower. A higher interest rate generally results in a higher value of the mortgage note, while a longer term or lower credit score may decrease its value. These factors all influence the risk associated with the mortgage note, which directly impacts its value.

To calculate the present value of your future mortgage payments, you can use a present value formula or a financial calculator. You will need to know the interest rate, the term of the loan, and the amount of each future payment. By discounting the future payments back to their present value using the interest rate, you can determine the current value of your mortgage note.

Understanding the value of your mortgage note is important for evaluating its worth and potentially selling it in the secondary market. It’s also important for borrowers to consider the factors that impact the value of their mortgage note when obtaining a loan. By considering the interest rate, credit score, and other relevant factors, borrowers can maximize the value of their mortgage note and potentially save money in the long run.

Reasons to Sell a Mortgage Note

Property owners may choose to sell their mortgage notes for a variety of reasons. One common reason is the need for immediate liquidity. Selling the note can provide the property owner with a lump sum of cash that can be used to address financial needs or opportunities, such as paying off high-interest debt, investing in another property, or funding a major expense.

Another reason to sell a mortgage note is to diversify an investment portfolio. Holding a mortgage note represents a significant portion of a property owner’s assets tied up in a single investment. Selling the note can free up capital to invest in other opportunities, spreading out the risk and potentially increasing returns.

Additionally, some property owners may choose to sell their mortgage notes if they are not satisfied with the performance of the investment. This could be due to concerns about the creditworthiness of the borrower, changes in the property’s value, or simply the desire to move on to other ventures.

Before deciding to sell a mortgage note, property owners should evaluate their personal financial needs and goals. It’s important to carefully consider the implications of selling, as well as explore all available options. Seeking professional financial advice can be helpful in making an informed decision about whether selling a mortgage note is the right choice.

The Process of Selling a Mortgage Note

Selling a mortgage note for a lump sum involves several important steps. The first step is to find a reputable buyer or company to work with. It’s essential to research potential buyers thoroughly and ensure they have a solid track record and are trustworthy.

Once a buyer is selected, it’s important to understand the legal and financial aspects of the transaction. This involves gathering all necessary documents related to the mortgage note, including the original promissory note, mortgage, and any other relevant paperwork. It’s also important to consult with legal and financial professionals to fully understand the implications of selling the mortgage note and to ensure all legal requirements are met.

After finding a buyer and understanding the legal and financial aspects, the next step is to negotiate the terms of the sale. This will involve determining the lump sum that will be paid for the mortgage note, as well as any other pertinent details of the transaction.

Once the terms are agreed upon, the final step is to complete the sale by transferring the mortgage note to the buyer in exchange for the lump sum payment. This may involve signing a purchase agreement and other transfer documents, as well as ensuring all necessary parties are informed of the transfer.

Preparing Your Mortgage Note for Sale

When preparing to sell a mortgage note, it is crucial to gather all the necessary paperwork and documentation related to the note and the underlying property. This may include the original mortgage agreement, any amendments or modifications, payment history, insurance documentation, and any other relevant paperwork. It is important to ensure that all paperwork is organized and readily accessible for potential buyers or their representatives.

In addition, before selling your mortgage note, it is essential to ensure that the note is in good standing. This means verifying that the borrower is up to date on payments and that there are no defaults or delinquencies. It is also important to double-check the terms of the mortgage note and any applicable laws or regulations to ensure compliance. If there are any issues with the note, such as missed payments or legal complications, it is important to address these before attempting to sell the note.

By taking the time to gather all necessary paperwork and documentation and ensuring that the mortgage note is in good standing, you can increase the value and marketability of your note when it comes time to sell. It is also advisable to seek professional guidance from a real estate attorney or financial advisor to ensure that all necessary steps are taken before selling the mortgage note.

Negotiating the Purchase Price

Negotiating the purchase price of your mortgage note can be a complex process, but with the right strategies and considerations, you can ensure a fair price for your note. Firstly, it’s essential to understand the factors that affect the value of your mortgage note, such as the remaining balance, interest rate, payment history, and property value.

When negotiating the purchase price, consider the market conditions and interest rates, as they can impact the value of your note. Additionally, the creditworthiness of the payer and the terms of the note also play a significant role in determining the fair price.

To negotiate a fair price for your mortgage note, consider seeking multiple offers from different note buyers to compare and leverage in negotiations. Highlight the strengths of your mortgage note, such as a high-interest rate or a solid payment history, to justify your asking price. Be prepared to counteroffer and negotiate the terms and price to reach a mutually beneficial agreement.

Overall, it’s crucial to thoroughly analyze the factors that impact the value of your mortgage note and be prepared to negotiate with potential buyers to secure a fair purchase price.

Closing the Deal

Closing the deal and transferring ownership of a mortgage note involves ensuring all legal requirements are met to finalize the sale. This process includes confirming that the buyer has met all necessary conditions and has the funds available to complete the purchase. It is vital to review and approve all documentation related to the sale, such as the purchase agreement, assignment of the mortgage note, and any other relevant contracts. Additionally, it’s important to verify that the seller has the legal authority to transfer ownership of the mortgage note.

Once all legal requirements are confirmed, the transfer of ownership can be completed. This typically involves drafting and executing a deed of assignment or similar document to formally transfer the mortgage note from the seller to the buyer. It’s important to ensure that this transfer is recorded with the appropriate authorities to update the public records and officially recognize the new owner of the mortgage note.

By carefully following all necessary legal steps and documentation, the sale of the mortgage note can be successfully finalized, and ownership will be effectively transferred to the buyer.

Conclusion

Selling a mortgage note for a lump sum can provide property owners with numerous benefits, including unlocking immediate cash for financial needs, avoiding the risks associated with holding the note, and gaining the flexibility to invest in other opportunities. The process is simple: property owners can connect with a reputable note buyer, receive a fair evaluation of their note, and negotiate a lump sum payment in exchange for transferring the rights to the note. By considering this option, property owners can free up funds to pay off debts, invest in new ventures, or simply enjoy a more comfortable financial future. So, if you are a property owner looking for a way to meet your financial needs, it’s worth exploring the potential of selling a mortgage note for a lump sum. This decision can provide you with the financial freedom and flexibility you need. Unlock the cash you need and take control of your financial situation today.